We’ve made a video which can be sent to employees so that they can understand how these new programs work. Please, feel free to share!

On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act requiring companies to provide both limited paid sick leave and expanded family and medical leave to employees impacted by the COVID-19 outbreak.

Benefits are limited to individuals directly affected by COVID-19, whether they are caring for themselves or others. Benefits begin April 1, 2020 and are in effect through the end of this year. The provisions apply to employers with fewer than 500 employees, however, the Department of Labor can exempt certain small businesses with fewer than 50 employees, as well as health care workers and emergency responders (additional guidance included in the F.A.Q.).

Employers may claim 100 percent of COVID-19-related leave wages as a refundable credit against federal payroll taxes (including social security, medicare, and federal income taxes) withheld from the employee and the employer’s portion of Medicare. In the case that those credits do not fully reimburse the cost of the leave, employers can seek an expedited advance from the IRS through a forthcoming claims process.

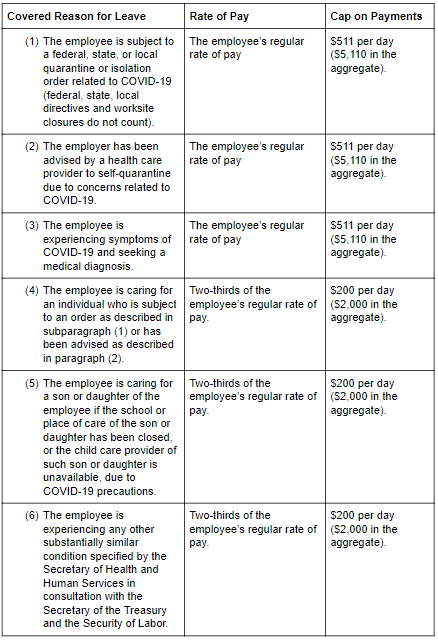

In general, employers are required to provide 10 days of paid sick leave and 10 weeks of paid family leave. The chart below outlines timelines for the paid leave, compensation calculations, and maximum payout caps.

We also have a free resource here, that helps you calculate the cost of your employees for both Emergency Paid Sick Leave and Expanded Family and Medical Leave. This spreadsheet also helps you weigh your options against the Paycheck Protection Program.

Emergency Paid Sick Leave

Covered Employees: all employees, including seasonal and part-time workers

Covered Employers: employers with fewer than 500 employees

Amount of Leave:

Full-time employees: 80 hours of paid leave

Calculated at their regular rate of pay (as calculated by the FLSA) or the minimum wage, whichever is greater.

Part-time employees: Average hours worked over a two-week period.

If an employee works a variable schedule, it is the average number of hours they worked per day over the previous six months. If the employee has not worked this long, it is the reasonable expectation of the employee at the time of hire or

Expanded Family and Medical Leave Expansion Act

Covered Employees: An employee has been employed for at least 30 calendar days (based on hire date).

Covered Employers: An employer with fewer than 500 employees.

Amount of Leave: 12 weeks, the first 2 weeks are unpaid leave and the remaining 10 weeks are paid leave with reinstatement rights.

First 10 days may be unpaid (but employees may use other paid leaves during this time - most employees will qualify for Emergency Paid Sick Leave to cover the first 10 days).

PAID LEAVE F.A.Q’s

Additional Q&A’s can be found on the Department of Labor website here.

Is a federal, state or local quarantine or isolation order the same as a shutdown order for purposes of FFCRA?

No. If, prior to or after April 1st, you send your employees home and stop paying them due to lack of work, they will not get paid sick leave or expanded family and medical leave but you may be eligible for unemployment insurance benefits. This is true whether you close the business for lack of business or because it is required to close pursuant to a Federal, State, or local directive. You should contact your State workforce agency or State unemployment insurance office for specific questions about your eligibility.

What are the exemptions for employers with fewer than 50 employees?

A small business with fewer than 50 employees may be exempt if an officer of the business has determined that one of the following three conditions have been met:

Paid sick leave or expanded FMLA would result in the small business to cease operating at a minimal capacity;

The absence of the employee(s) would entail substantial risk to the financial health or operational capabilities of the small business due to specialized skills, knowledge of business, responsibilities; or

There are not sufficient workers who are able, willing, qualified, and available at the time and place needed for the small business to operate at a minimal capacity.

Are the paid sick leave and expanded family and medical leave requirements retroactive?

No.

When does an employer count employees to determine if they are at or above 50 or 500?

The employer should count the total full-time and part-time employees within the United States, District of Columbia, or any Territory or possession of the United States at the time the employee’s leave is to be taken (April 1st at the earliest).

Can these wages be paid by the Paycheck Protection Program (PPP)?

This cannot be combined with the PPP program. The leave is not covered by the PPP and can only be paid back through the tax credits. The EPSL and Expanded FMLA are direct offsets against any federal payroll tax liability and cannot be counted towards wages as far as loan forgiveness for the PPP.

Additional Resources For Employers

A Massachusetts DUA Pamphlet which must be provided with layoffs

FMLA Employee Request Form for employees to complete

Emergency Paid Sick Leave Request Form for employees to complete

Additional Resources For Employees

Filing by phone in MA not available - but you can schedule a call back via an online form

How to file a new unemployment claim powerpoint

How to file a new unemployment claim video